Our Services

Invest in Seychelles, work or set up a business.

Acquire a boat or real estate.

You rest in the Seychelles Islands, vacation or short term stay.

Invest in Seychelles, work or set up a business.

Offshore IBC (international Business Company)

- The company off shore has Memorandum specifying activities in which the enterprise can be committed.

- These activities are regulated by specific legislation.

- The company offshore is incorporated by one or several physical or moral persons.

- It can have a preceded denomination or followed by ”Ltd.“, “Inc.”, ”Corp.“

- There is no minimum capital, most often the capital is set at USD 100,000, it can be USD 1 or USD 1,000,000.

- No obligation to depose the capital.

- Possibility to have nominee director or nominee shareholders.

- The shares are exclusively registered.

- The client doesn’t need to go to Seychelles islands, all the constitution can be alone done through internet.

- The International Business Company (IBC) of Seychelles can be the owner of vessels planes, buildings (not in Seychelles).

- The Seychelles Offshore Company can invest in TRUSTS, investment funds.

- • The registered office must be in Seychelles with a registered agent.

- The annual tax fixed for the life of the Company off shore is USD 140 whatever the capital; IT’S THE ONLY TAX TO BE PAID.

- An IBC in Seychelles is exempt from all profit tax, transfer taxes etc … unless it trades on Seychelles territory, which is possible in part since 2019, in which case it is subject to a “business tax” as a local company.

- Keeping the records of the Seychelles Offshore Company accounts for 7 years is an obligation.

Advantages of IBC Located in Seychelles jurisdiction

- Large choice of names possible.

- Relatively preserved confidentiality.

- Total exemption from tax, levy, stamp duty, tax (except annual flat rate tax).

- No capital gains, no inheritance tax.

- No compulsory account deposit but obligation to keep the archives of the Seychelles Offshore Company accounts for 7 years.

- Banking secret.

- Registered shares.

- No requirement for a local manager.

- The cheapest annual tax in the world.

- No obligation to hold general meetings.

- Possibility to open a bank account for your Seychelles offshore company anywhere in the world.

Activities of the offshore company in Seychelles

The Seychelles offshore company may engage in any lawful activity except the restrictions below.

It can trade with all countries even with Seychelles and it can own and manage vessels registered in Seychelles.

The new law clarifies that an IBC may own or operate a vessel registered in Seychelles under the Merchant Shipping Act and the vessel may visit Seychelles or be located in Seychelles territorial waters, provided the IBC does not ‘does not carry out any commercial activity in the Seychelles.

Restriction of activities:

The law (act 2016) on International Business Company does not allow an IBC in Seychelles to have the following activities:

- have an interest in real estate or rent real estate in Seychelles.

- have an insurance or reinsurance business.

- carry out an activity of International Corporate Service, international trustee or foundation and the following activities unless they are authorized or otherwise legalized under the laws of the country outside the Seychelles where the Seychelles offshore company carries out this activity.

- securities broker;

- operation of a mutual fund;

- online casinos;

- stockbroker, bank, trust;

- cryptomoney

Company CSL (Company Special Licence)

The Company CSL (Company Special License) is a legal structure in Seychelles governed by the Seychelles Companies Act 1972 supplemented by the provisions of the Companies Act 2003.

http://www.fsaseychelles.sc/index.php/legal-framework/fiduciary

This structure is more expensive than an offshore IBC (International Business Company) company, but offers the advantage of benefiting from double taxation drafts signed by Seychelles, considered as tax resident in Seychelles.

Double taxation treaties

The Seychelles Islands have to date concluded several double taxation treaties with the following countries: Barbados, Botswana, China, Cyprus, Indonesia, Malaysia, Mauritius, Oman, Qatar, South Africa, Thailand, United Arab Emirates, Vietnam etc …

The Seychelles jurisdiction regularly signs treaties and our list is not kept up to date, you can consult directly by following the link: https://www.src.gov.sc/pages/resources/dtas.aspx

The incorporation of a Company Special License in Seychelles allows to benefit from the tax provisions of Seychelles and to benefit from the treaties without double taxation.

The laws are the Seychelles Companies Act 1972 and by the 2003 Act specific to Special Business License companies.

Benefits of a CSL Company "Special Business License" in Seychelles

The corporate purpose of this company can be:

Human resources company, recruitment company; Franchise company; Investment advice; Offshore banking reinsurance and insurance; Investment company; “Holding” company “Marketing” advertising company; Company owning intellectual property; Company headquarters; any activity in the International Free Zone, and in general any activity approved by the Seychelles authority.

A special business license in Seychelles is exempt from tax on assets or dividends, on royalties. It is also exempt from the registration fee on transfers of property, shares or other financial transactions.

A special business license is exempt from commercial tax on all supplies and equipment for the use of its offices in Seychelles.

As of January 1, 2019, CSLs are taxed in accordance with the applicable tax rates specified in the “Business Tax Act”.

- For a CSL with a turnover of one million rupees or less, the rate is 1.5% of turnover or 25% of profit.

- For a CSL with a turnover of over one million rupees, the rate is 30% of profit.

In addition, they benefit from an exemption from social security contribution and work permit rights for its expatriate staff for 10 years, which must not exceed 50% of its total workforce. The identity of directors, partners or economic beneficiaries is communicated to the authorities but not disclosed to the public.

The bank account can be opened in the Seychelles Islands or in another country.

Obligations of a CSL Company Special License in Seychelles

Company Special License companies pay:

- a royalty of 200 USD annually for account processing

- an annual license of USD 1,000

- administration fees of 200 USD

The capital of a special business license can be in the chosen currency, no minimum is required, and the amount of capital does not have to be released for registration formalities.

The memorandum of a Company Special License must be signed by at least TWO partners, the TWO directors who must be natural persons but not yet resident in Seychelles, must consent to their appointment, as well as the resident secretary (an international corporate service provider).

Our company prepares you in all the administrative procedures for creating and maintaining your business Special license: business plan, drafting of articles of association in English, certification by a notary, putting in touch with the accountant, the secretary etc …

Maritime Business Onshore, Offshore, Ship Registration

Maritime activity in Seychelles is booming, however it is always necessary to differentiate between two types of business;

- On shore or activity carried out on the territory with a local company or in the Free Zone.

- Offshore or activity carried out outside the Seychelles.

- Onshore: Many sectors of activity are reserved exclusively for Seychellois (taxi, diving club, etc.).

Other activities require the presence in the capital of one or more Seychellois partners.

We cannot in these pages make an exhaustive list of possible activities or not, so we invite you to contact us by email.

After checking with the administrative services, we will send you a free response by email within 48 hours.

The offshore business will be used for the acquisition of a vessel navigating in territorial waters or for the operation of a vessel in other seas. Each case is specific: tax and marital status, nationality of the owner, type of boat, place of operation, etc.

We cannot explain all the situations, so send us your questions by email, we will do our best to answer you as quickly and simply as possible.

The rules for registering of boat under the Seychelles flag

To safeguard the image of Seychelles and to avoid “the wrecks” the limiting age of the boat to be recorded is fixed at 15 years, with however possibilities of exemption for well-maintained ships.

Conditions:

If the boat is not in territorial waters of Seychelles, it is possible to record it temporarily in a diplomatic representation Seychelles abroad.

The provisional recording is valid for 90 days renewable.

- For a new boat of series,

the permanent recording can be done directly through an application which we submit at the Port authorities of Victoria. - For a boat of not standard occasion (limited series),

the ship must be appraised by a company of classification recognized by the Seychelles authorities.

For the owners who wish it, a representative of our company can travel with a person in charge for the MSA (Maritime Safety Administration) in order to check the state of the yacht. If the ship corresponds to the standards, all the authorizations necessary for the recording of the aforesaid boat will be delivered at the time of this inspection, and the boat could be recorded directly.

Certificate and other documents

Depending on the type of boat the following certificates can be provided.

- Boat class certificate;

- Cargo safety equipment certificate;

- Cargo construction certificate;

- International Pollution Prevention Certificate;

- Clean handling certificate;

- Loading certificate;

- Radio certificate;

- Declaration of transfer of the boat;

- Certificate of Sale of the boat;

- Sanitary certificate for fishing;

- Cargo equipment certificate;

- Certificate of cancellation;

- Certificate of incorporation of the company;

Formalities and Cost of the Seychellois Flag

The costs are as follows:

- Constitution and registration of your offshore company with a capital of 5,000 USD including government taxes, head office, postal address, sending of documents by special carrier,

from 1.900 Euros - Constitution and registration of your pleasure boat, your yacht less than 15 years old including government taxes, sending of documents by special courier,

from 3.800 Euros - Different options like director for the offshore structure, telephone and fax service…. Are invoiced in addition on estimate

International Maritime Laws

International navigation regulations are very strict and each country has its own laws.

It is obvious that when it comes to navigation safety and marine pollution, every navigator worthy of the name must take responsibility.

We are only concerned with the tax advantages that certain arrangements can bring you.

Remember that these structures are completely legal and meet international provisions.

The Seychelles Islands are members of the United Nations, the Commonwealth, the Organization of African Unity (OAU), the Indian Ocean Commission (IOC), as well as the International Maritime Organization (IMO). As such, pleasure boats, yachts or merchant ships flying the Seychellois flag receive friendly treatment worldwide, but also through their undisputed adherence to respect for marine and terrestrial fauna and flora.

Benefits of the Seychellois Flag

The advantages of pleasure boats, yachts or commercial vessels registered under the Seychelles flag are exempt:

- from VAT or VAT

- from profit tax

- from capital gain

- ONLY an annual tax of 300 USD is due for the pleasure yacht regardless of its tonnage.

To the advantages described above (absence of VAT, absence of added value, prohibitive taxes, we must add, the increased ease of transferring the ownership of the pleasure boat, the yacht or the commercial vessel by transfer of shares, and the peace of the owners, in particular in matters of seizure. The pleasure boat, yacht being outside the patrimony, on these gains, it is advisable to add the absence of inheritance taxes and taxes on the great fortune.

Constitution of SIB files

Preparation of files, Presentation to administrations; Support for investors;

This administration is required to verify all aspects of the project (health, environmental impact, impact on the life of the population, jobs, influence of the Seychelles, etc.) to measure its feasibility and to ensure the source of the investments, and the identity of investors.

This phase is crucial to start your business, however building a file for the SIB (Seychelles Investment Board) can be very long and complicated, especially when investors are far from Seychelles and not very available.

Our firm can advise and represent them.

Obtaining a license for your business

| Seychelles Investment Board P.0. Box 1167 2nd Floor, Caravelle House Manglier Street Victoria |

Seychelles Licensing Authority (SLA) P.O.Box 3 Ground Floor, Orion Mall Building Victoria |

| Registrar Kingsgate House Victoria |

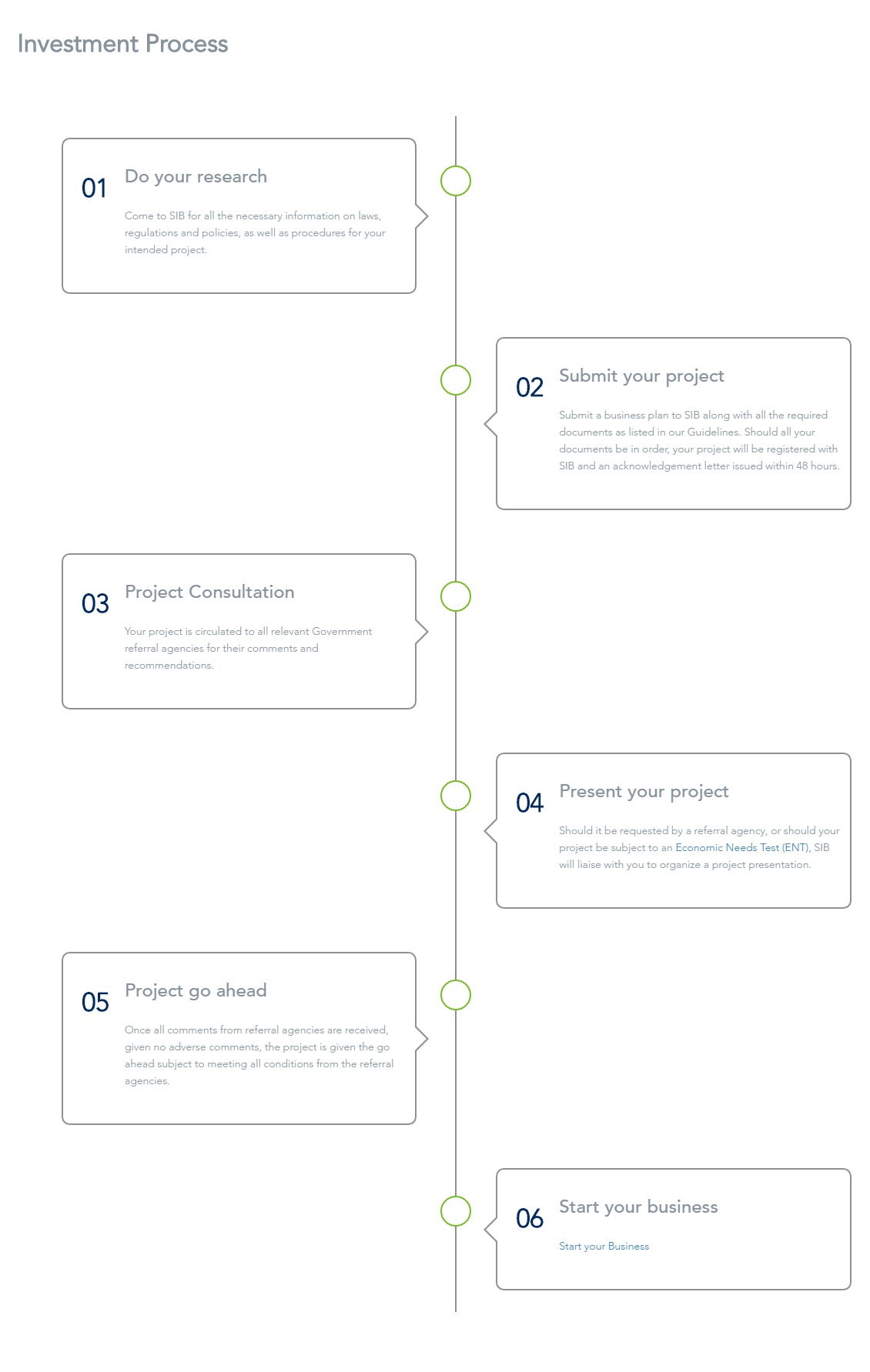

Steps in the Seychelles Investment Process

Obtaining a Work Permit

A work permit can be obtained without difficulty by creating a company in the Free Zone. Entrust us with your project and we will study together the best way to proceed.

To get a work permit, you must have an employer (Seychellois or other) or have your own business (GOP).

This permit is valid for one year, renewable, and depending on the function SR 1.500 months.

The company already established, will request the immigration work permits for the foreigner and it shall give a minimum contribution of 1.500 SR.

If the foreign company wants to establish itself, it must first submit an application to the SIB (Seychelles Investment Bureau) to obtain all necessary permits for future work.

Several activities are reserved for Seychellois (taxi, diving, car rental, travel agency, tour operator …). This list is not comprehensive.

Obtaining a Residence Permit

Living in Seychelles without work, requires a resident permit. This is valid for 5 consecutive years and renewable. An application must be submitted to the immigration and the condition is valid up to 5 years SR 150,000 per person. Spouses officially benefit from a rate of 50%, and children are free up to 18 years old.

The resident permit is granted free to all operators and their potential expatriate staff (50%), and their respective families.

In certain cases, if the permit application is submitted by owners in condominiums at Eden Island, the price of SR 150,000 for the whole family is given if the application is made within 6 months of acquisition.

Immigration office

Independence house 1st floor

Victoria

Your correspondent in Seychelles.